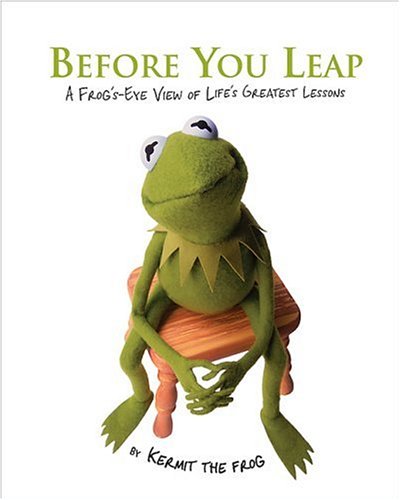

A Frog’s Eye View of Life’s Great Lessons

Floating around the Internet are any number of THINGS TO DO BEFORE YOU TURN 30. This list, for example, includes the following:

- Write a book

- Start a budget

- Volunteer in a developing country

- Enjoy a really expensive bottle of wine

- Learn to play the guitar

- Climb Mount Kilimanjaro

- Learn to scuba dive

- Take a road trip

- Eat fearlessly

- Teach a child to do something

- Cook like Mom and Dad

- Go skydiving

- Read the Bible

- Get a tattoo

- Learn to sail

- Kick your worst vice

- Buy some adult toys for yourself

- Begin an investment portfolio

- Build your own website

- Go to a psychic

- Go deep-sea fishing

- Run a marathon

- Pay off all your debt

- Go on a yoda/meditation retreat

- Join an improv troupe

- Learn a new language

- Learn to swing dance

- Bluff your way into a job you’re totally not qualified for

- Go on an African safari

- Go on a pilgrimage

And all the items on this list are certainly fine goals that one should strive to achieve at some point in their life, but considering how many of these are iterations of the same themes — “learn to” and “go to” with some risk-taking thrown in, a list like this really has no practical matter as a guide of THE TYPES OF THINGS ONE REALLY SHOULD HAVE DONE BY THE TIME YOU’RE 30.

- Have $10,000 stashed away in a savings account. We’re not talking about money you have in investments, CDs, bonds, or other money-placements — we’re talking in addition to all that. Maximize your 401k, pay off all your debt — these are givens in today’s society. The real key is whether you have an emergency cushion of easily-obtainable cash to protect yourself when times get rough or if you need to make a purchase that’s just a little out of your normal comfort zone. Some financial advisors say that your emergency fund should cover between three and six months worth of expenses. Having $10,000 in a savings account, readily available, should qualify for most people.

- Maintained a steady job for at least five years. We know that not everyone is going to get their dream job right our of college. But if you can’t hold a job with the same company for five years sometime between the ages of 20 and 30, then you’ve either picked the wrong career or the wrong industry. There’s nothing wrong with changing jobs or career choices midstream, and we understand that there is always the possibility of extended unemployment or child-raising that could keep you out of the job market for an extended period of time. So do the best you can to earn your five-year-pin.

- Travel. Find the time to travel. Day trips, road trips, long weekends – whatever it takes to see the rest of the country and the world at whatever comfort level you have. Whether it be travel for work or pleasure, or travel involving moving at least 60 miles away from home – the goal is to experience how other areas live and not be tied down to a specific city or area. By surrounding yourself with different people or different cultures/beliefs/lifestyles – you’ll find yourself growing more as a person than if you stayed isolated and living in a proverbial bubble.

- Surround yourself with friends. Sure, family will always be there for you, but make sure you have a support group of friends and neighbors that you can count on to be there for you as well (and you for them). Who knows? Perhaps in that large circle of friends, you may find the love of your life. You certainly don’t stand a chance of finding your life’s love sitting around with family or waiting for the single Avon Lady to ring your bell.